TRO in Finance: Complete Guide to Total Return Options and Trading Strategies

What’s a to in finance?

A to, or total return option, represent a sophisticated financial derivative that allow investors to gain exposure to the total return of an underlie asset without straightaway own it. This innovative instrument capture both price appreciation and income distributions, make it a powerful tool for portfolio diversification and risk management.

Total return options differ from traditional options by incorporate dividend payments, interest distributions, and other income streams alongside capital gains. This comprehensive approach provide investors with a more complete picture of an asset’s performance, make Troy peculiarly attractive for institutional investors and sophisticated traders.

Key components of total return options

Understand the fundamental elements of Troy help investors grasp their potential applications and benefits. The total return calculation include several critical components that distinguish these instruments from conventional derivatives.

Price appreciation component

The price appreciation element capture the capital gains or losses of the underlie asset. This component functions likewise to traditional options, respond to market movements and volatility in the underlying security’s value.

Income distribution element

Troy incorporate dividend payments, coupon distributions, and other income streams generate by the underlie asset. This feature make them specially valuable for income focus investment strategies and provide exposure to the full economic benefit of asset ownership.

Reinvestment assumptions

Most Troy assume automatic reinvestment of distributions, compound the total return over the option’s life. This reinvestment feature enhance the potential returns and aligns with long term investment strategies.

Types of total return options

The to market offer various structures design to meet different investment objectives and risk profiles. Each type serve specific purposes and appeals to different investor segments.

Equity total return options

These instruments provide exposure to individual stocks or equity indices while capture dividend payments. Equity Troy are popular among investors seek leveraged exposure to stock market performance without the capital requirements of direct ownership.

Source: lamiradaespecial.blogspot.com

Fixed income total return options

Bond base Troy capture both price movements and coupon payments, offer investors a way to express views on interest rate movements while maintain income exposure. These instruments prove valuable during periods of change monetary policy.

Commodity total return options

Commodity Troy provide exposure to physical commodities while incorporate storage costs, convenience yields, and other factors affect total returns. These instruments help investors navigate the complexities of commodity invest without direct physical exposure.

Trading strategies use Troy

Professional traders employ various strategies with total return options to achieve specific investment objectives while manage risk exposure.

Hedging strategies

Portfolio managers use Troy to hedge exist positions while maintain exposure to income distributions. This approach allow for risk reduction without sacrifice potential dividend income or coupon payments.

Speculation and leverage

Traders utilize Troy to gain leveraged exposure to total returns with limited capital outlay. This strategy amplify both potential gains and losses, require careful risk management and position size.

Income enhancement

Some strategies involve sell Troy to generate premium income while maintain underlying asset exposure. This approach can enhance portfolio yields but require active management and monitoring.

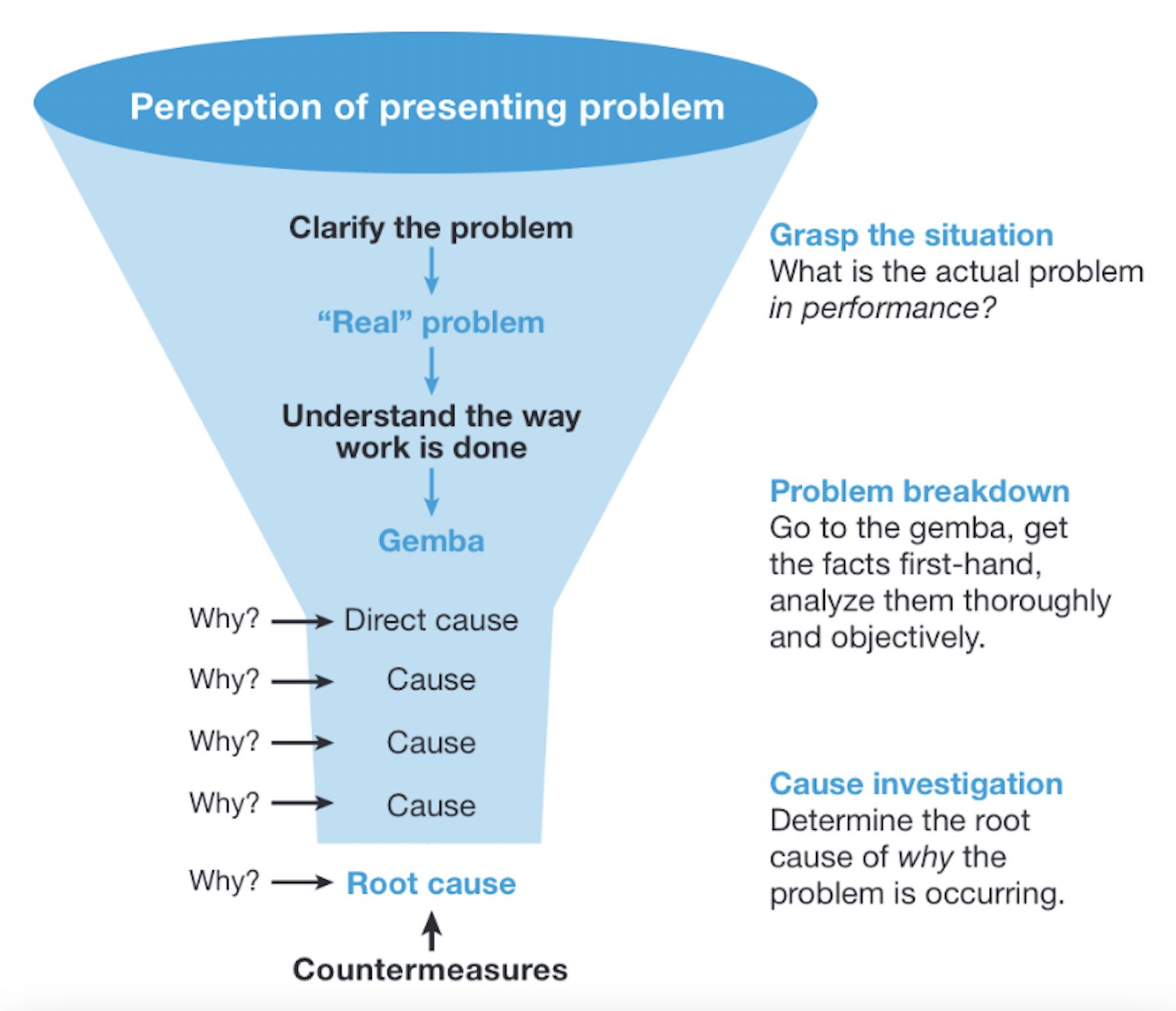

Pricing and valuation of Troy

The valuation of total return options involve complex mathematical models that account for multiple variables affect total returns.

Black Sholes modifications

Traditional option pricing models require modifications to accommodate the income component of Troy. These adjustments account for expect distributions and their impact on total returns.

Volatility considerations

To pricing must consider the volatility of both price movements and income distributions. This dual volatility component aaddscomplexity to valuation but provide more accurate pricing.

Dividend yield impact

Expect dividend yields importantly influence to pricing, specially for equity base instruments. Changes in dividend policy or yield expectations can dramatically affect option values.

Risk management with total return options

Effective risk management remain crucial when trade Troy due to their complexity and multiple risk factors.

Market risk

Troy expose investors to underlie asset price movements, require careful monitoring of market conditions and volatility levels. Position sizing and diversification help manage this exposure.

Income risk

Changes in dividend policies or interest rate environments can affect the income component of Troy. Investors must monitor issuer financial health and policy announcements that might impact distributions.

Liquidity risk

Some to markets may have limited liquidity, make position entry and exit challenge. Understand market depth and trading volumes help manage this risk.

Regulatory environment and compliance

The regulatory framework surround Troy continue to evolve as these instruments gain popularity among institutional investors.

Report requirements

Financial institutions trade Troy must comply with various reporting requirements, include position disclosure and risk metric calculations. These regulations help maintain market transparency and stability.

Capital requirements

Banks and investment firms must maintain adequate capital reserves when trading Troy, reflect the instruments’ risk profiles and potential exposures.

Market participants and usage

Various market participants utilize Troy for different purposes, create a diverse and dynamic trading environment.

Institutional investors

Pension funds, insurance companies, and asset managers use Troy for portfolio diversification and risk management. These large investors appreciate the instruments’ ability to provide comprehensive exposure with limited capital requirements.

Hedge funds

Sophisticated hedge fund strategies oft incorporate Troy for both directional bets and relative value trades. The instruments’ complexity and leverage potential appeal to these professional investors.

Investment banks

Banks serve as both market makers and proprietary traders in to markets, provide liquidity and develop new product variations to meet client demands.

Technology and to trading

Advanced technology play a crucial role in to trading, from pricing models to execution systems.

Algorithmic trading

Sophisticated algorithms help traders identify opportunities and manage risk in to markets. These systems can process multiple data streams and execute complex strategies mechanically.

Risk management systems

Real time risk monitoring become essential when trade Troy due to their multiple risk factors. Advanced systems track exposures and alert traders to potential issues.

Future developments in to markets

The to market ccontinue to evolvewith new product developments and technological advances.

ESG integration

Environmental, social, and governance factors progressively influence to development, with new products incorporate eESGmetrics into total return calculations.

Digital assets

The emergence of cryptocurrency and digital asset Troy represent a growth market segment, though regulatory uncertainty remain a challenge.

Artificial intelligence

Machine learning and AI technologies are improvedtoo pricing models and trading strategies, enhance market efficiency and risk management capabilities.

Practical considerations for investors

Investors consider Troy should understand several practical aspects before incorporate these instruments into their portfolios.

Minimum investment requirements

Many to products have substantial minimum investment thresholds, limit access to institutional and high net worth investors. Understand these requirements help determine accessibility.

Tax implications

The tax treatment of to gains and losses can be complex, peculiarly regard the income component. Consult with tax professionals ensure proper compliance and optimization.

Due diligence requirements

Thorough analysis of underlying assets, counterparty risk, and market conditions remain essential before invest in Troy. This research helps identify potential opportunities and risks.

Total return options represent a sophisticated evolution in derivative instruments, offer comprehensive exposure to asset performance while provide flexibility in implementation. As markets continue to develop and technology advanceTroyros are likely to pla an progressively important role in professional investment strategies and risk management frameworks.

MORE FROM techitio.com