Personal Wellness Accounts: Complete Guide to Health Benefit Programs

Understand personal wellness accounts

A personal wellness account (PWA) is a specialized health benefit program design to help individuals pay for qualify health and wellness expenses. Unlike more rigid healthcare accounts, PWAs typically offer greater flexibility in how funds can be used to support overall wellbeing.

These accounts represent a growth trend in employee benefits packages, reflect an increase focus on preventive care and holistic wellness approaches. For many people, PWAwa serve as a valuable complement to traditional health insurance coverage.

How personal wellness account work

Personal wellness accounts function as employer fund benefit accounts. The employer deposit a predetermine amount of money into the account, which employees can so access to pay for eligible wellness expenses. Unlike health savings accounts (hhas))r flexible spending accounts ( f(sSASp)s dPWAs typically involve employee contributions.

The mechanics are straightforward:

- Employers determine an annual allocation amount per employee

- Funds become available at the beginning of the benefit period

- Employees submit claims for reimbursement of eligible expenses

- Administrators review and approve valid claims

- Reimbursements are process through direct deposit or check

Most PWAs operate on a use it or lose it basis, mean unused funds don’t roll over to the next benefit year. This encourages employees to actively engage with their wellness benefits kinda than save them indefinitely.

Eligible expenses under personal wellness accounts

One of the primary advantages of PWAs is their broader coverage compare to traditional medical accounts. While specific eligible expenses vary by employer and plan design, they typically include:

Physical wellness

- Gym memberships and fitness classes

- Exercise equipment

- Personal training sessions

- Sports league fees

- Race registration fees

- Fitness trackers and apps

Mental wellness

- Meditation and mindfulness apps

- Stress management programs

- Mental health counseling (when not cover by insurance )

- Sleep improvement tools

Nutritional wellness

- Nutritional counseling

- Cooking classes focus on healthy eating

- Weight management programs

- Certain vitamin and supplement purchases

Preventive care

- Health screenings not cover by insurance

- Vaccinations

- Smoking cessation programs

- Health coaching

Some progressive PWA programs yet cover expenses like massage therapy, acupuncture, chiropractic care, and other complementary health approaches that traditional health insurance might exclude.

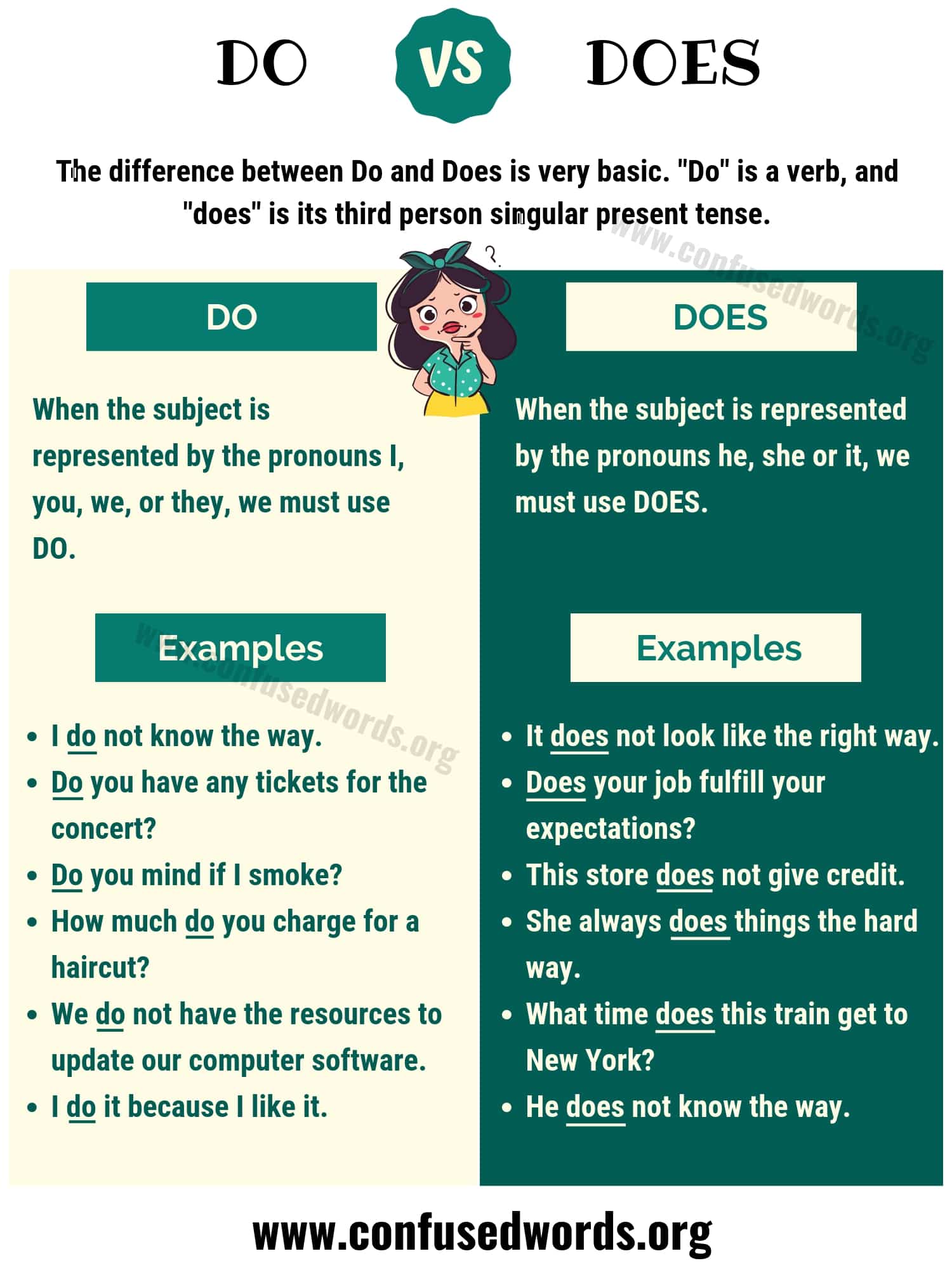

PWAs vs. Other health accounts

To full understand personal wellness accounts, it helps to compare them with other common health benefit accounts:

PWA vs. Health savings account (hHSA)

While both help pay for health relate expenses, they differ importantly:

- Funding: Has accept both employer and employee contributions; pPWAsare typically employer fund exclusively

- Eligibility: Has require enrollment in a high deductible health plan; pPWAshave no such requirement

- Tax status: Has offer triple tax advantages ((atax-freeontributions, growth, and withdrawals for qualified expenses ))pwaPWAsn’t offer tax benefits to employees

- Portability: HSA funds belong to the employee perpetually; PWA funds typically stay with the employer if you leave

- Eligible expenses: Has cover iIRSdefine medical expenses; pPWAsoft cover a broader range of wellness expenses

PWA vs. Flexible spending account (fFSA)

SAS and pPWAsshare some similarities but serve different purposes:

- Funding: SAS accept employee contributions ((ith potential employer matching ))pwaPWAse employer fund

- Rollover: Both typically have limit or no rollover of funds year to year

- Eligible expenses: SAS cover qualified medical expenses as define by the iIRS pPWAscover wellness expenses as define by the employer

- Claim process: SAS oftentimes offer debit cards for immediate payment; pPWAstypically require reimbursement claims

PWA vs. Health reimbursement arrangement (hHRA)

Has and pPWAsshare the employer funding model but differ in purpose:

Source: bijab.com

- Purpose: Has help cover oout-of-pocketmedical expenses and insurance premiums; pPWAsfocus on wellness and prevention

- Integration: Has are typically iintegratedwith health insurance plans; PWAs stand alone as supplemental benefits

- Eligible expenses: Has cover qualified medical expenses; pPWAscover wellness expenses

Benefits of personal wellness accounts

For employees

PWAs offer numerous advantages for workers:

- Financial support For wellness activities that might differently be unaffordable

- Encouragement To engage in preventive health measures

- Flexibility To choose wellness activities that match personal interests and needs

- Reduce out-of-pocket costs For maintaining a healthy lifestyle

- Access to wellness options Not cover by traditional health insurance

For employers

Companies implement PWAs for several strategic reasons:

- Reduced healthcare costs Through prevention and early intervention

- Decreased absenteeism Due to improve employee health

- Enhanced productivity From healthier, more engaged employees

- Improved talent attraction and retention Through competitive benefits

- Demonstration of commitment To employee well bee

- Customizable benefit That can be tailored to workforce demographics

Research systematically show that wellness programs with financial incentives like PWAs yield better participation rates and outcomes than programs without monetary support.

Set up a personal wellness account

If you’re an employee interested in a PWA, the process typically involves:

- Check if your employer offer a PWA as part of your benefits package

- Complete any require enrollment forms during open enrollment or new hire orientation

- Review the specific eligible expenses cover by your employer’s plan

- Understand the claim submission process and documentation requirements

- Set up direct deposit for reimbursements if available

For employers look to implement a PWA program, the process involves:

- Consult with benefits advisors to design an appropriate program

- Determine funding amounts and eligible expense categories

- Select a third party administrator to manage the program

- Create clear communication materials for employees

- Establish a process for review and approve claims

- Develop metrics to evaluate program effectiveness

Maximize your personal wellness account

To get the most value from a PWA, consider these strategies:

Plan your wellness spending

At the beginning of each benefit year, create a wellness plan that align with your health goals and the eligible expenses under your PWA. This might include schedule regular fitness activities, plan preventive care appointments, or invest in home exercise equipment.

Understand deadlines

Since most PWAs don’t allow rollover, be aware of the deadline to use your funds. Some plans may offer a grace period after the end of the benefit year to submit claims for expenses incur during the cover period.

Keep detailed records

Maintain organized records of all wellness relate expenses, include receipts that clear show:

- Date of purchase or service

- Vendor or provider name

- Description of the product or service

- Amount pay

Bundle services when possible

If your PWA cover services like personal training or nutritional counseling, consider purchase packages of multiple sessions preferably than individual appointments. This oftentimes provide better value and ensure you use your benefit before it expire.

Combine with other benefits

Look for ways to strategically combine your PWA with other health benefits. For example, use your health insurance for covered preventive care and your PWA for complementary wellness services not include in your medical plan.

Common challenges and solutions

Challenge: unclear eligible expenses

Solution: Request a detailed list of cover expenses from your benefits’ administrator. When in doubt about a specific expense, ask forpre-approvall before make the purchase.

Challenge: complicated claim process

Solution: Familiarize yourself with the claim submission process other. Many administrators directly offer mobile apps that simplify the process by allow you to photograph and upload receipts direct from your smartphone.

Challenge: forget to use funds

Solution: Set calendar reminders at regular intervals throughout the year to check your remain balance and plan appropriate wellness activities.

Challenge: limited provider options

Solution: Some PWA programs restrict coverage to specific providers or partners. If your preferred wellness provider isn’t covered, ask youbenefits’ts administrator about the possibility of add them to tapprovalove list.

The future of personal wellness accounts

As workplace wellness continue to evolve, personal wellness accounts are likely to become more sophisticated and personalize. Emerge trends include:

- Integration with wearable technology To track wellness activities and mechanically trigger rewards

- Expansion of eligible expenses To include emerge wellness categories like financial wellness and social wellbeing

- Personalized wellness recommendations Base on health risk assessments and individual preferences

- Virtual wellness services Include online fitness classes, telehealth counseling, and digital health coaching

- Gamification elements That make wellness activities more engaging and rewarding

The COVID-19 pandemic has accelerated many of these trends, peculiarly the shift toward digital wellness solutions that can be access from anyplace.

Source: cariskpartners.com

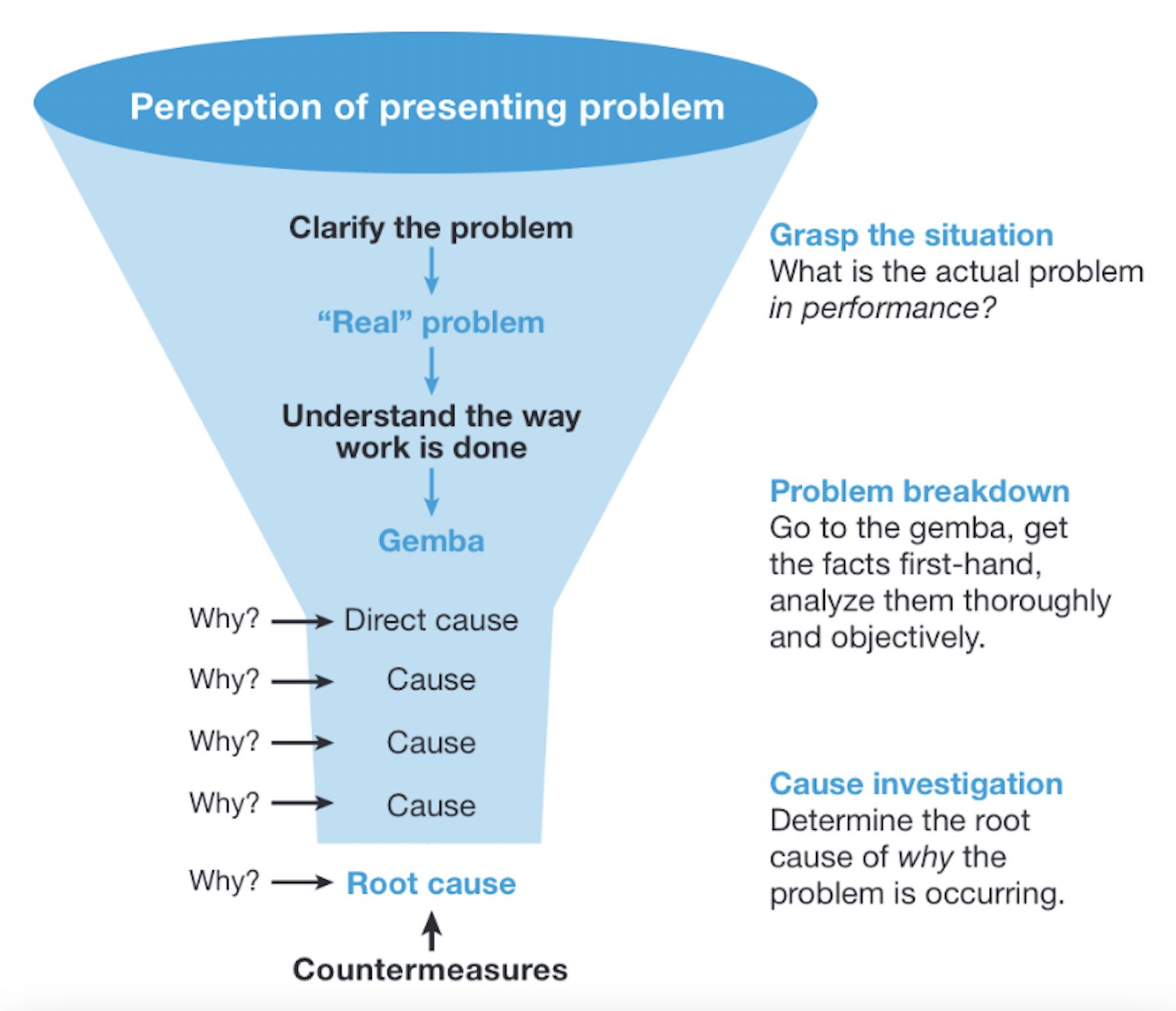

Final thoughts on personal wellness accounts

Personal wellness accounts represent an innovative approach to employee benefits that acknowledge the importance of proactive health management and preventive care. By provide financial support specifically for wellness activities, these accounts help bridge the gap between traditional healthcare coverage and the broader spectrum of activities that contribute to overall wellbeing.

For employees, PWAs offer an opportunity to explore wellness options that might differently be financially out of reach. For employers, they provide a structured way to invest in workforce health while demonstrate a commitment to employee well bee beyond basic healthcare coverage.

As healthcare costs continue to rise and the connection between wellness and productivity become progressively clear, personal wellness accounts are likely to become a standard component of competitive benefits packages. By understand how these accounts work and how to maximize their value, both employers and employees can contribute to a healthier, more productive workplace.

Whether you’re considered implement PWAwa program for your company or look to make the most of one offer by your employer, the key is to approach wellness as an ongoing investment kinda than a one time expense. With thoughtful planning and consistent engagement, personal wellness accounts can serve as powerful tools for support long term health and wellbeing.

MORE FROM techitio.com