Financing a Bugatti: Exploring Luxury Car Loan Options

Finance a Bugatti: is it possible?

The allure of own a Bugatti represent the pinnacle of automotive achievement. These engineering marvels command prices start around $2–3 million for base models, with limited editions well exceed $10 million. While most ultra wealthy buyers purchase these vehicles unlimited, a common question persists: can you really finance a Bugatti?

The short answer is yes, financing options do exist for Bugatti purchases. Nonetheless, the reality differs dramatically from conventional auto loans, with specialized requirements, substantial down payments, and financial scrutiny that exceed typical lending processes.

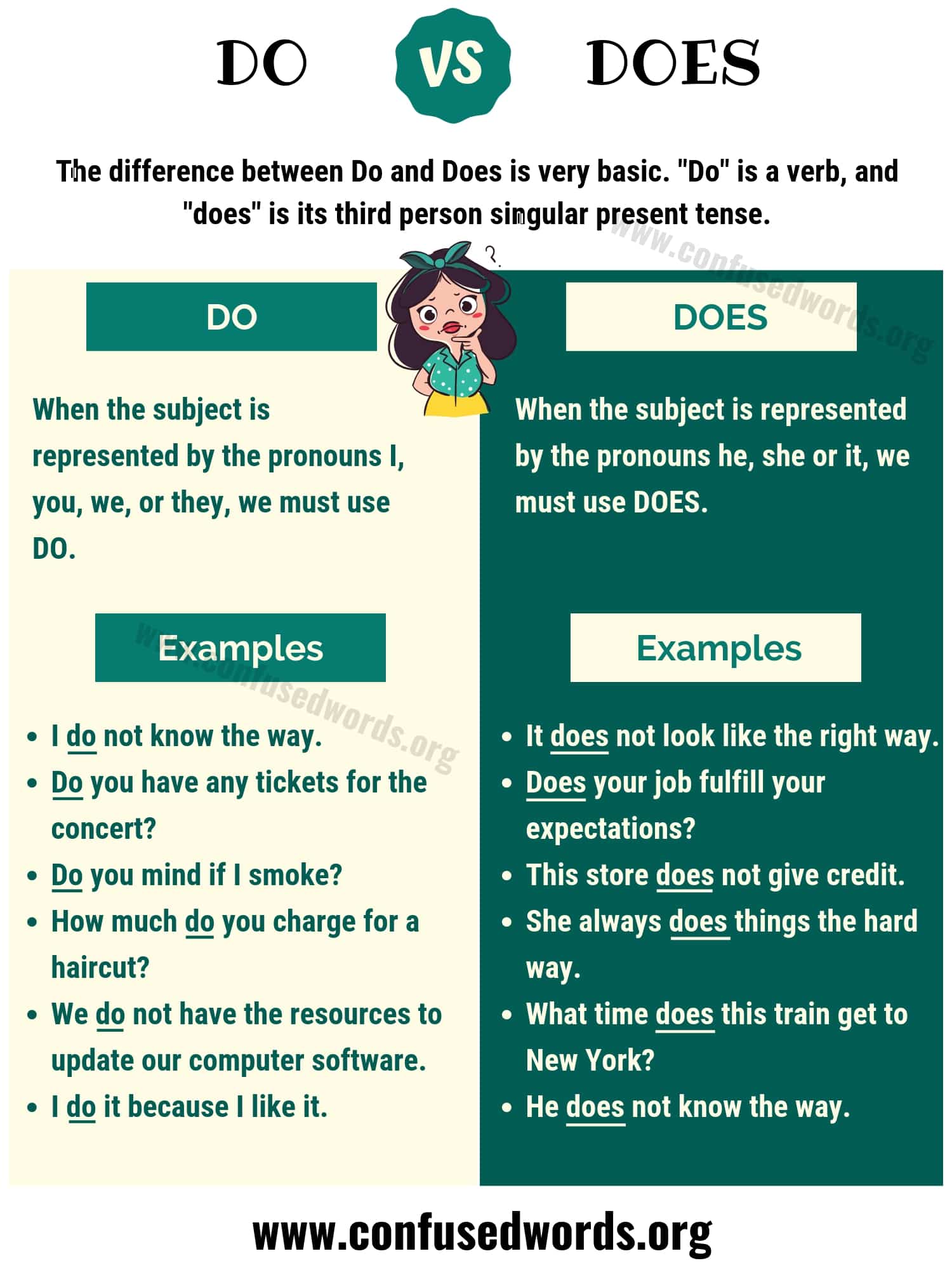

Understand Bugatti financing options

Conventional auto lenders seldom offer loans for hypercars like Bugatti. Alternatively, prospective buyers typically work with:

Specialized luxury asset lenders

Financial institutions that focus solely on high net worth clients offer tailor financing programs for luxury assets. Companies like Jr capital, premier financial services, and woodside credit specialize in exotic and luxury vehicle financing. These lenders understand the unique nature of hypercar investments and can structure appropriate terms.

Private banking relationships

Ultra-high net worth individuals oftentimes leverage exist private banking relationships to arrange financing. Private banks may offer portfolio back loans use securities or other assets as collateral, potentially at more favorable terms than dedicated auto loans.

Manufacturer financing

Bugatti occasionally offers in house financing through partnerships with select financial institutions. These arrangements typically cater to establish clients with previous purchase history and strong financial credentials.

Financial requirements for Bugatti financing

Finance a vehicle worth multiple millions require exceptional financial qualifications:

Source: pinterest.com

Income and net worth thresholds

Lenders typically require annual income in the seven figure range and total net worth exceed $10 30 million. Documentation of consistent income streams and substantial liquid assets is mandatory.

Substantial down payments

Unlike conventional auto loans where 10 20 % down payments are standard, Bugatti financing typically require 30 50 % down payment at minimum. For a $3 million bBugatticChiron this ttranslatesto an upfront payment of $900,000 to $$15 million.

Exceptional credit profile

Beyond perfect credit scores (800 + ) lenders scrutinize complete financial histories, include business ventures, investment portfolios, and exist debt obligations. Any financial irregularities can instantly disqualify potential buyers.

Asset verification

Lenders require comprehensive verification of assets, include investment accounts, real estate holdings, business interests, and other significant assets. This process frequently involves multiple rounds of documentation and verification.

Typical financing terms for hypercars

When financing arrangements are approved, terms differ importantly from standard auto loans:

Interest rates

Interest rates for hypercar financing typically range from 5 12 %, depend on the buyer’s financial profile, relationship with the lender, and overall loan structure. These rates exceed those of conventional auto loans due to the specialized nature of the asset.

Loan duration

Most Bugatti financing arrangements span 3 5 years, importantly shorter than mainstream auto loans. Some specialized programs may extend to 7 years, but longer terms are rare and oftentimes come with less favorable conditions.

Balloon payment structures

Many hypercar loans utilize balloon payment structures, where monthly payments cover interest and a portion of the principal, with a substantial final payment due at the end of the term. This approach reduce monthly obligations but require significant liquidity at loan maturity.

Collateral requirements

Beyond the vehicle itself, lenders may require additional collateral, include other vehicles, real estate, or investment accounts. Cross collateralization provide additional security for the lender give the specialized nature of the asset.

The true cost of finance a Bugatti

The purchase price represents exclusively the beginning ofBugattii ownership costs. Prospective buyers must consider numerous additional expenses:

Insurance premiums

Annual insurance for a Bugatti typically range from $50,000 to $$150000, depend on coverage levels, drive history, garage facilities, and usage patterns. Specialized insurers like haHaggertynd aAIGprivate client group offer tailor policies for hypercars.

Maintenance costs

Bugatti maintenance costs eclipse conventional luxury vehicles. Annual service can exceed $30,000, with major service intervals potentially reach $$100000 +. Simple operations like oil changes can cost $ $2500 due to the complex engine design require significant disassembly.

Depreciation considerations

While certain limited edition Bugatti models appreciate, standard production models typically experience depreciation, though at slower rates than mainstream luxury vehicles. Finance a depreciate asset require careful consideration of loan to value ratios throughout the ownership period.

Storage and security

Proper climate control storage facilities, enhance security systems, and potentially dedicated staff add significant ongoing costs to Bugatti ownership that must factor into total financing calculations.

Alternative approaches to Bugatti ownership

Beyond traditional financing, alternative pathways to Bugatti ownership exist:

Lease options

Specialized exotic car leasing programs offer alternatives to outright purchases. These arrangements typically require significant upfront payments (much 30 40 % of vehicle value )but provide flexibility at lease end. Mileage restrictions are severe, frequently limit usage to 2,500 5,000 miles yearly.

Fractional ownership

Companies like rally RD. and curated offer fractional ownership models where multiple investors share ownership of a single vehicle. While this reduce individual financial commitment, it to limit access and usage rights.

Membership clubs

Exclusive automotive clubs like fast toys club and Petersen automotive museum’s vault collection provide members with limited access to hypercars without ownership responsibilities. Annual membership fees typically range from $100,000 to $$250000.

Financial considerations before pursue Bugatti financing

Financial advisors highlight several considerations for potential Bugatti buyers:

Opportunity cost

The substantial capital require for Bugatti ownership represent significant opportunity cost. The same investment in diversify portfolios could potentially generate greater returns over equivalent timeframes.

Total cost of ownership analysis

Beyond financing costs, comprehensive analysis should include insurance, maintenance, storage, transportation, and potential depreciation. Five year ownership costs typically exceed the vehicle’s purchase price when all factors are considered.

Liquidity planning

Bugatti ownership require maintain substantial liquidity for unexpected expenses, market fluctuations, and potential balloon payments. Financial advisors typically recommend that hypercars represent no more than 5 10 % of a high net worth individual’s total asset allocation.

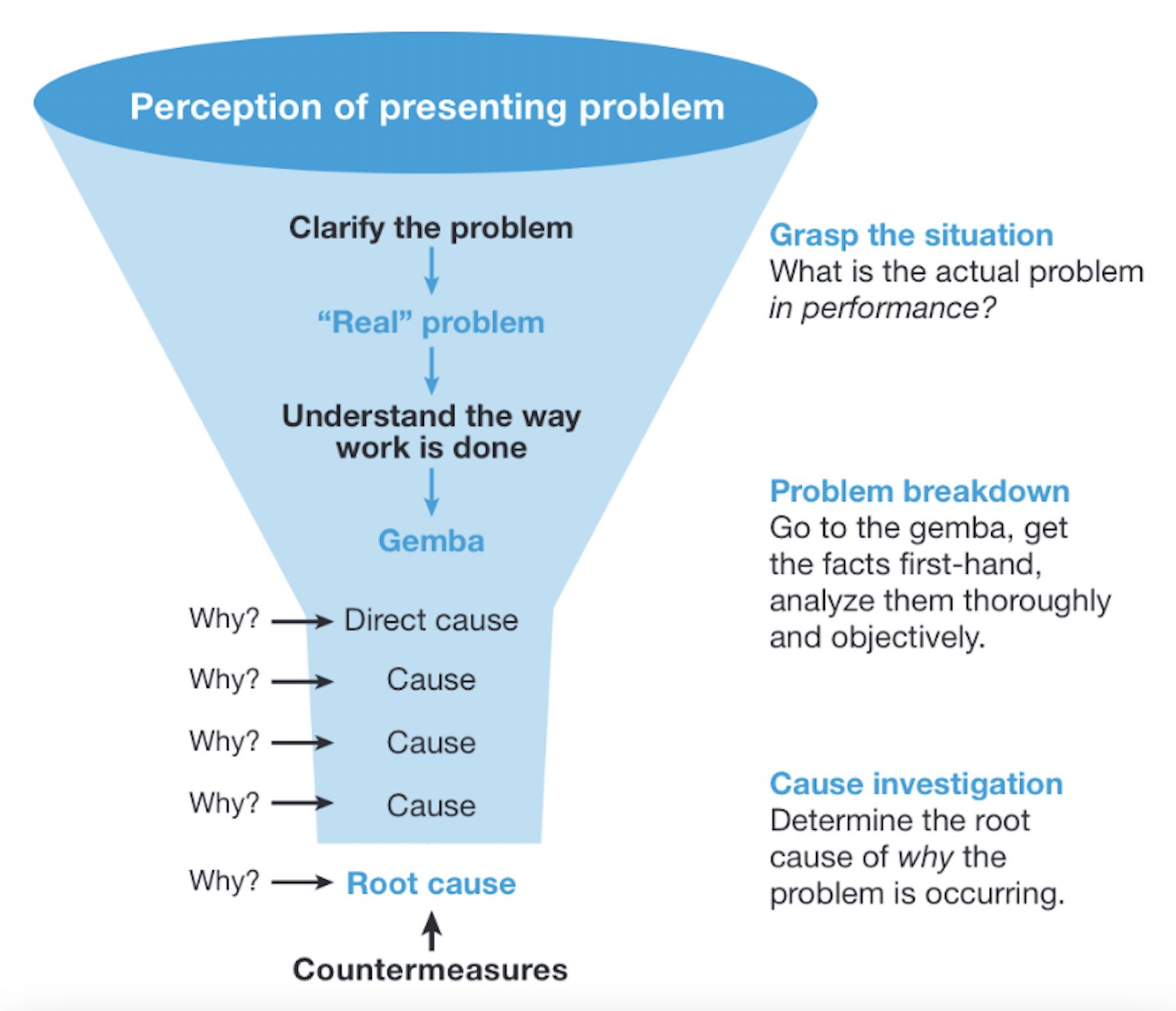

The application process for hypercar financing

The financing application process for vehicles like Bugatti involve several specialized steps:

Initial consultation

The process typically begins with confidential consultations with specialized lenders or private banking representatives. These preliminary discussions establish financing parameters, include down payment requirements, term options, and collateral expectations.

Source: pinterest.com

Documentation requirements

Applicants must provide comprehensive financial documentation, include:

- Multiple years of personal and business tax returns

- Complete investment portfolio statements

- Real estate holdings documentation

- Business ownership verification

- Comprehensive credit reports

- Banking relationships and account statements

- Exist debt obligations and payment histories

Underwriting process

The underwriting process for hypercar financing extend beyond automate systems, involve manual review by senior underwriters and oft committee approval. This process typically takes 2 4 weeks, importantly yearn than conventional auto loans.

Vehicle appraisal and inspection

Lenders require independent appraisals and inspections of the specific Bugatti being purchase, include verification of provenance, condition assessment, and authentication of all documentation.

Is finance a Bugatti financially prudent?

Financial advisors broadly categorize Bugatti purchases as luxury expenditures kinda than investments, with rare exceptions for certain limited edition models with prove appreciation histories.

Investment perspective

From a strictly financial standpoint, finance a production Bugatti seldom constitute an optimal investment strategy. The combined impact of interest costs, depreciation, and ongoing expenses typically exceed potential appreciation for most models.

Lifestyle consideration

For ultra-high net worth individuals where the financing costs represent a small fraction of overall wealth, the lifestyle value and exclusivity of Bugatti ownership may justify the financial implications. In these cases, financing decisions oftentimes hinge on cash flow optimization kinda than affordability concerns.

Collector strategy

Establish collectors may strategically finance certain acquisitions to maintain liquidity for other opportunities. This approach require sophisticated understanding of the collector car market and typically involve consultation with specialized advisors.

Conclusion: the reality of Bugatti financing

While financing options exist for Bugatti purchases, they remain accessible exclusively to the financial elite with exceptional wealth, perfect credit histories, and substantial liquid assets. The stringent requirements reflect both the extreme value of these vehicles and the specialized nature of hypercar lending.

For the vast majority of automotive enthusiasts, Bugatti ownership remain an aspiration quite than a realistic possibility. Notwithstanding, understand the financing mechanisms for these extraordinary vehicles provide insight into the financial structures support ultra luxury purchases.

Finally, those with the financial means to consider a Bugatti purchase should approach financing decisions with the same precision and attention to detail that characterize these engineering masterpiece themselves – with careful consideration of all financial implications, ownership responsibilities, and long term objectives.

MORE FROM techitio.com