Basic Areas of Finance: Understanding the Core Foundations of Financial Management

Understand the core areas of finance

Finance serve as the backbone of every business operation and personal financial decision. The discipline encompass several fundamental areas that work unitedly to create a comprehensive framework for manage money, investments, and financial resources. Understand these basic areas help distinguish what genuinely belong within the finance domain and what fall outside its scope.

The finance field has evolved importantly, but its core foundations remain consistent. These fundamental areas provide the structure upon which all financial analysis, planning, and decision make rest. Whether you’re a student explore career options, a professional seeking to understand interdisciplinary connections, or a business owner make strategic decisions, recognize these basic areas prove essential.

Corporate finance: the heart of business financial management

Corporate finance stand as one of the near recognize areas within the finance discipline. This area focus on how businesses manage their financial resources, make investment decisions, and optimize their capital structure. Corporate finance professionals analyze cash flows, evaluate investment opportunities, and determine the best methods for funding business operations and growth.

Key responsibilities within corporate finance include capital budgeting, where companies decide which projects deserve investment base on expect returns and risk assessments. Financial managers besides handle work capital management, ensure businesses maintain adequate liquidity to meet short term obligations while maximize efficiency.

Dividend policy represent another crucial aspect of corporate finance. Companies must balance return value to shareholders through dividends against retain earnings for future growth opportunities. This decision straightaway impact stock prices and investor satisfaction.

Mergers and acquisitions fall square within corporate finance territory. Financial professionals evaluate potential targets, structure deals, and assess the financial implications of combine businesses. These transactions require deep understanding of valuation methods, due diligence processes, and integration strategies.

Investment management: grow and preserve wealth

Investment management constitute another fundamental area of finance, focus on how individuals and institutions allocate capital across various asset classes to achieve specific financial objectives. This area encompass portfolio theory, asset allocation strategies, and risk management techniques.

Professional investment managers analyze market conditions, evaluate individual securities, and construct portfolios that balance risk and return accord to client needs. They consider factors such as time horizon, risk tolerance, and income requirements when develop investment strategies.

Modern portfolio theory provide the mathematical foundation for investment management. This framework help investors understand how different assets interact within a portfolio and how diversification can reduce overall risk without inevitably sacrifice returns.

Alternative investments have gain prominence within investment management. These include real estate, commodities, hedge funds, and private equity. Each alternative investment class offer unique risk return characteristics and correlation patterns with traditional stocks and bonds.

Behavioral finance has emerged as an important consideration within investment management. Understand how psychological biases affect investment decisions help professionals make more rational choices and avoid common pitfalls that can derail long term financial success.

Financial markets and institutions: the infrastructure of finance

Financial markets and institutions represent the third core area of finance, encompass the systems and organizations that facilitate the flow of capital throughout the economy. This area examine how financial markets operate, how institutions serve various stakeholder needs, and how regulatory frameworks maintain market integrity.

Source: askfilo.com

Stock markets, bond markets, and derivatives markets each serve specific functions within the broader financial system. These markets provide liquidity, enable price discovery, and allow risk transfer between different market participants. Understand market mechanics helps finance professionals navigate these systems efficaciously.

Banking institutions play a central role in financial markets by accept deposits, extend credit, and facilitate payments. Commercial banks, investment banks, and specialize financial institutions each serve distinct functions while contribute to overall economic stability and growth.

Insurance companies represent another crucial type of financial institution. They pool risks across large groups of policyholders, enable individuals and businesses to transfer specific risks in exchange for premium payments. This risk transfer function support economic activity by reduce uncertainty.

Regulatory bodies oversee financial markets and institutions to maintain stability, protect consumers, and ensure fair dealing. Understand regulatory requirements help finance professionals operate within establish guidelines while serve client need efficaciously.

International finance: manage global financial challenges

International finance address the complexities that arise when financial activities cross national borders. This area has grown progressively important as businesses expand globall, andd investment opportunities transcend geographic boundaries.

Exchange rate risk management represent a primary concern within international finance. Companies conduct business in multiple currencies must understand how exchange rate fluctuations affect their financial performance and implement appropriate hedging strategies.

International capital budgeting require additional considerations beyond domestic project evaluation. Political risk, regulatory differences, and vary tax structures all influence the attractiveness of international investments and expansion opportunities.

Global financial markets operate endlessly across different time zones, create opportunities for arbitrage and require sophisticated risk management approaches. Understand how different markets interact help finance professionals optimize their strategies and timing.

Sovereign debt and country risk analysis play important roles in international finance. Investors must assess the creditworthiness of national governments and understand how political and economic conditions affect investment outcomes.

Personal finance: individual financial well-being

Personal finance apply financial principles to individual and household financial decisions. While sometimes consider separate from institutional finance, personal finance share the same fundamental concepts and analytical approaches.

Budgeting and cash flow management form the foundation of personal finance. Individuals must balance income and expenses while allocate resources toward various goals such as emergency funds, retirement savings, and major purchases.

Investment planning for individuals involve many of the same concepts use in institutional investment management, but scale and adapt for personal circumstances. Asset allocation, diversification, and risk management remain crucial considerations.

Insurance planning help individuals protect against various risks that could derail their financial plans. Life insurance, disability insurance, and property insurance each serve specific protective functions within a comprehensive financial strategy.

Tax planning integrate with all aspects of personal finance, as tax implications affect investment returns, retirement savings, and estate planning decisions. Understand tax law help individuals optimize their financial strategies within legal frameworks.

Financial analysis and planning: the analytical foundation

Financial analysis and planning provide the analytical tools and methodologies use across all areas of finance. This area focus on interpret financial data, forecast future performance, and develop strategies base on quantitative analysis.

Financial statement analysis help stakeholders understand company performance, financial position, and cash flow generation. Ratio analysis, trend analysis, and comparative analysis provide insights into operational efficiency, profitability, and financial stability.

Valuation methods enable finance professionals to determine the worth of assets, companies, or investment opportunities. Discount cash flow analysis, comparable company analysis, and asset base valuation each offer different perspectives on value.

Financial modeling combine various analytical techniques to create comprehensive representations of financial situations. These models support decision-making by allow users to test different scenarios and assumptions.

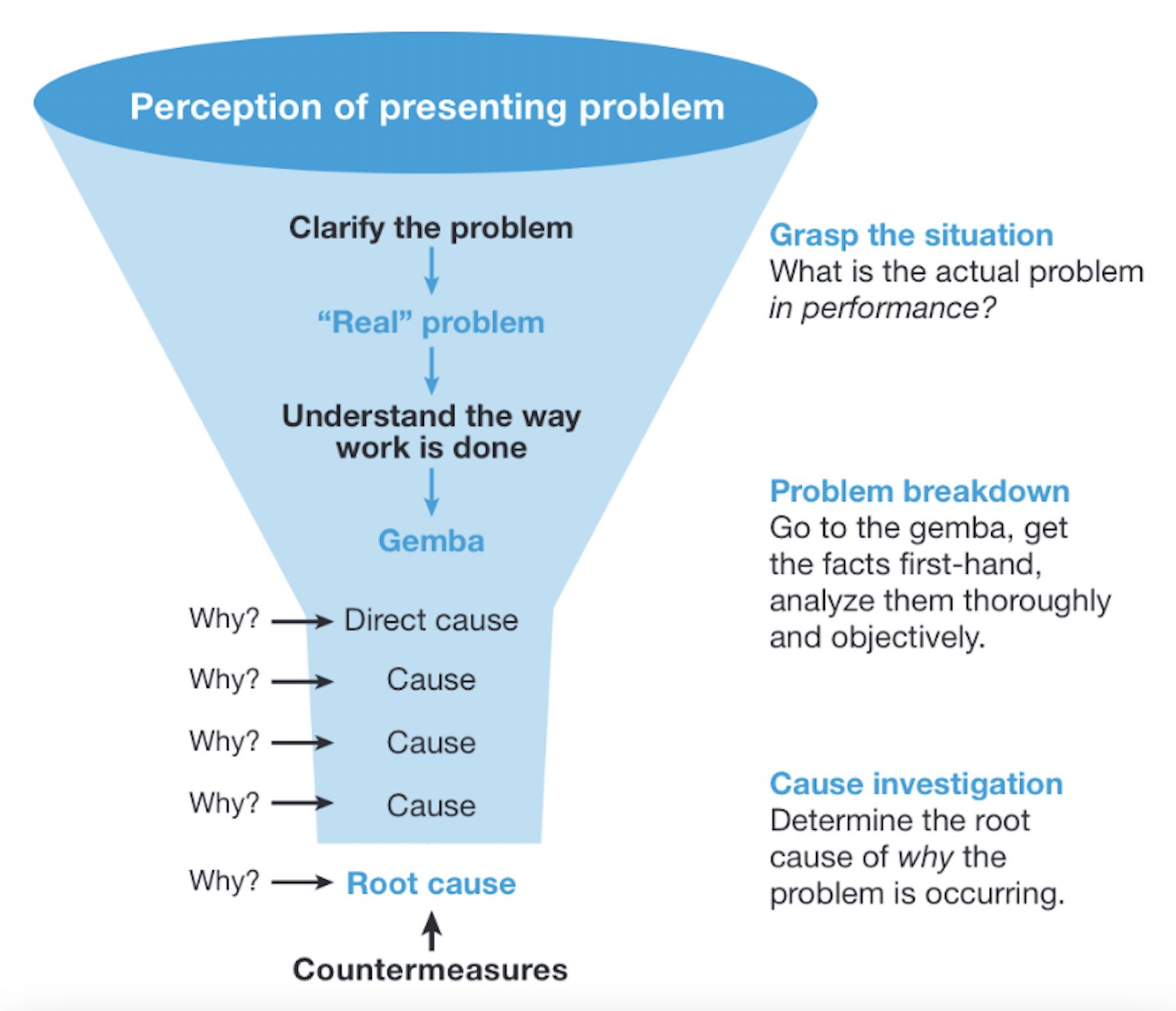

Risk assessment and management permeate all financial analysis and planning activities. Identify, measuring, and manage various types of risk help ensure that financial strategies remain robust under different conditions.

What falls outside the basic areas of finance

Understand what constitute the basic areas of finance require recognize what fall outside this discipline. While finance intersects with many other fields, certain areas maintain distinct identities and methodologies.

Marketing represent a separate business discipline focus on understand customer needs, develop products and services, and create communication strategies. While marketing decisions have financial implications, market itself employ different analytical frameworks and objectives than finance.

Operations management concentrate on optimize production processes, supply chain efficiency, and service delivery. Although operational decisions affect financial performance, operations management use distinct methodologies focus on process improvement instead than financial optimization.

Human resources management deals with recruiting, develop, and manage employees. While hr decisions impact financial results through compensation costs and productivity effects, hr professionals use behavioral and organizational frameworks kinda than financial analysis as their primary tools.

Information technology focus on systems, software, and data management. It supports financial functions through systems and analysis tools, but technology itself represent a separate discipline with its own specialized knowledge requirements.

Legal services address regulatory compliance, contract negotiation, and dispute resolution. While legal considerations affect financial decisions, legal analysis follow different principles and methodologies than financial analysis.

The interconnected nature of finance areas

The basic areas of finance do not operate in isolation. Corporate finance decisions affect investment management strategies. International finance considerations influence domestic financial planning. Personal finance principles scale up to institutional applications.

This interconnectedness mean that finance professionals benefit from understand multiple areas within the discipline. A corporate finance manager make international expansion decisions need to understand foreign exchange markets and international investment principles.

Technology has increased the integration between different finance areas. Modern portfolio management systems can simultaneously handle corporate treasury functions, investment management, and risk assessment across multiple markets and currencies.

Regulatory changes oftentimes affect multiple finance areas simultaneously. New banking regulations might impact corporate lending, investment management compliance requirements, and international capital flow entirely at erstwhile.

Career implications of understanding finance areas

Recognize the basic areas of finance help individuals make informed career decisions and understand professional development paths. Each area offer different types of challenges, work environments, and advancement opportunities.

Corporate finance careers oftentimes involve work straightaway with business operations, require strong analytical skills and business acumen. These roles typically offer clear advancement paths toward senior management positions.

Investment management careers focus on market analysis and portfolio construction. These positions require strong quantitative skills and the ability to work under pressure in quickly change market conditions.

Financial markets and institutions careers might involve sales, trading, or research roles. These positions oftentimes require specialized knowledge of specific market segments and strong communication skills.

International finance careers combine finance knowledge with cultural awareness and language skills. These roles oftentimes involve travel and work with diverse teams across different time zones.

Future evolution of finance areas

The basic areas of finance continue to evolve as technology, regulation, and market conditions change. Understand current foundations provide the flexibility to adapt to future developments.

Artificial intelligence and machine learning are transformed financial analysis and decision make processes. These technologies enhance traditional analytical methods while create new opportunities for insight and efficiency.

Sustainable finance has emerged as an important consideration across all finance areas. Environmental, social, and governance factors progressively influence investment decisions, corporate strategy, and regulatory requirements.

Cryptocurrency and blockchain technology represent new frontiers that intersect with traditional finance areas. These innovations challenge exist frameworks while create new opportunities for financial services and investment strategies.

The basic areas of finance provide a solid foundation for understand how financial systems operate and where different activities fit within the broader discipline. Recognize these core areas help distinguish genuine finance functions from related but separate business activities, support better decision-making and career planning in a progressively complex financial world.

Source: sci it clubs.blogspot.com

MORE FROM techitio.com